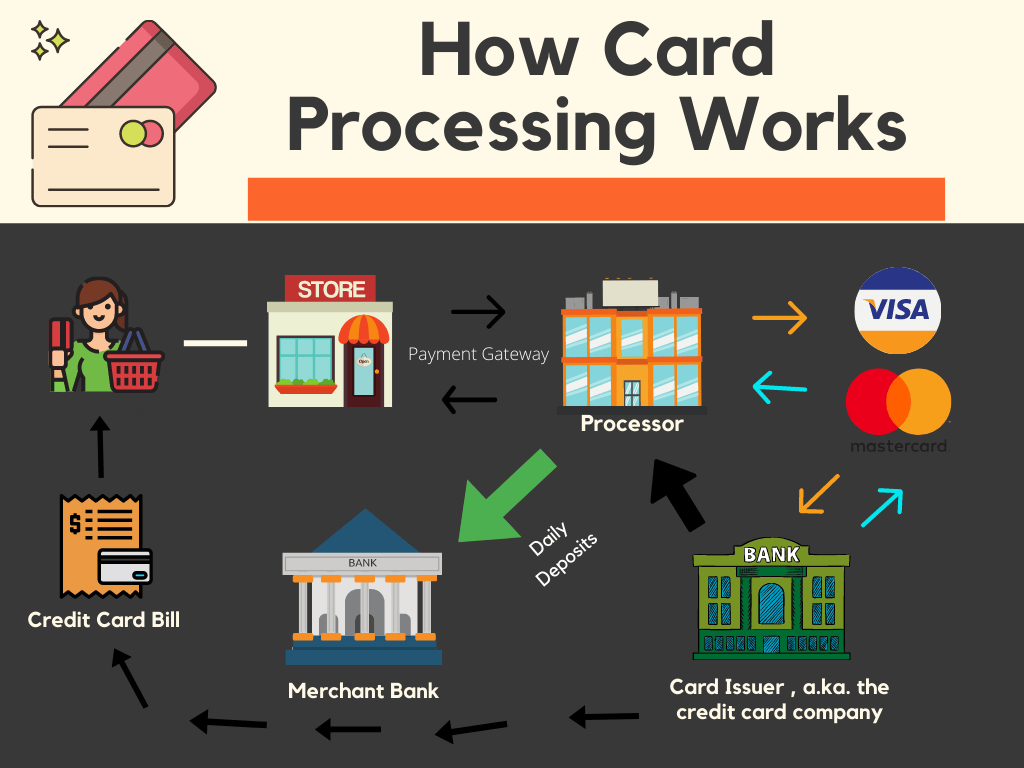

A charge card cost processor plays a essential position in the current financial landscape, serving as the linchpin that facilitates electric transactions between vendors and customers. These processors behave as intermediaries, linking corporations with the banking system and allowing the smooth move of funds. The fact of these purpose is based on translating the data from a credit card deal into a language understandable by financial institutions, ensuring that funds are licensed, processed, and settled efficiently.

Among the main operates of a charge card payment processor is always to enhance the efficiency of transactions. Each time a customer swipes, positions, or shoes their credit card, the payment processor swiftly assesses the deal details, communicates with the relevant financial institutions, and validates if the purchase may proceed. This process does occur in a subject of seconds, emphasizing the pace and real-time character of credit card cost processing.

Protection is really a paramount problem in the kingdom of financial transactions, and credit card payment processors are in the forefront of applying procedures to protect sensitive information. Sophisticated security systems and compliance with industry criteria ensure that client data stays secure through the entire payment process. These protection procedures not merely safeguard customers but additionally instill trust in organizations adopting electric cost methods.

The charge card payment processing environment is regularly evolving, with processors establishing to technical improvements and adjusting client preferences. Mobile obligations, contactless transactions, and the integration of electronic wallets symbolize the lead of advancement in this domain. Bank card payment processors enjoy a crucial position in allowing businesses to stay forward of the styles, providing the infrastructure required to aid diverse payment methods.

Beyond the traditional brick-and-mortar retail space, charge card cost processors are crucial in powering the great landscape of e-commerce. With the rise of on line looking, processors help transactions in a virtual setting, handling the intricacies of card-not-present scenarios. The ability to easily understand the difficulties of electronic commerce underscores the flexibility and usefulness of credit card payment processors.

World wide commerce depends seriously on charge card payment processors to aid transactions across borders. These processors handle currency conversions, address global submission demands, and make certain that businesses may operate on a global scale. The interconnectedness of economic programs, supported by bank card cost processors, has converted commerce in to a truly borderless endeavor.

Credit card payment processors lead somewhat to the development and sustainability of little businesses. By offering electric payment possibilities, these processors allow smaller enterprises to grow their client bottom and compete on an even playing field with greater counterparts. The accessibility and affordability of bank card payment running solutions have become crucial enablers for entrepreneurial ventures.

The landscape of bank card cost running also requires concerns of fraud elimination and regulatory compliance. Payment processors apply robust measures to find and prevent fraudulent activities, guarding equally organizations and consumers. Moreover, remaining abreast of ever-evolving regulatory demands ensures that transactions abide by appropriate criteria, become a credit card processor the reliability and integrity of the payment processing industry.

To conclude, credit card payment processors type the backbone of contemporary economic transactions, facilitating the smooth flow of resources between companies and consumers. Their multifaceted position encompasses rate, security, flexibility to technological changes, and help for global commerce. As engineering remains to improve and consumer choices evolve, charge card payment processors will remain main to the active landscape of electronic transactions, shaping the ongoing future of commerce worldwide.